Execution at the Edge: Why We Need Builders, Not Just Ideas

In summary: Much of what we need to address climate and nature degradation already exists, from innovations to capital. What holds us back is execution. That is where capital has hesitated, and solutions have often failed to achieve results. The responsibility for taking action has become fragmented across systems that don’t work together, and it is precisely in this space that the next phase of climate and nature action is determined. Not by who invents more, but by who can move what already works into the world systematically. Execution has become the defining factor of our time, and it is also where the greatest opportunity now lies.

The Bottleneck

Most of the technologies we need to hit global climate goals already exist.

According to analysis from major advisory firms, roughly 90% of the technologies required for carbon neutrality in key sectors are available today [1]. So if the tools are already here, why do we still lag so far behind?

The answer is execution.

The gap is not primarily technical. It is about deploying, scaling, funding, and integrating solutions at speed and at scale across systems that were not built for rapid transformation.

Capital Is There, But It’s Too Slow.

Global climate finance flows have grown significantly: private climate finance alone recently surpassed €850 billion, and total climate finance may exceed €1.7 trillion annually [2].

Yet, even with these record figures, mobilizing capital into real-world impact remains uneven and too slow. The world’s financial system still struggles to:

- Transform capital commitments into investable opportunities

- Align risk and return with long-term outcomes

- Channel funding into the hardest-to-finance but highest-impact sectors

The consequence is stark: deep deployment gaps persist even where solutions exist and where economic opportunity is real. Capital doesn’t lack potential. It lacks the framework, execution capacity, and systemic structures to reliably move from promise to impact at pace.

The Execution Imperative

What is clear from recent sectoral and finance analyses is that the major barriers are not conceptual or technological, but structural and operational. Successful scaling requires three intertwined capabilities:

- Pipeline Development and Bankability

A steady stream of investable projects that meet investor thresholds for risk, return, and scalability; standardized frameworks that reduce due diligence friction and unlock institutional capital. - Mobilizing Catalytic Capital Strategically

Patient, risk-tolerant capital that can absorb early-stage uncertainty and de-risk investments for broader private flows. Catalytic finance plays a multiplier role when deployed smartly, enabling later-stage institutional inflows that are orders of magnitude larger. Catalytic capital has been widely identified as a key lever for unlocking later-stage institutional investment [4][5]. - Ecosystem Alignment

Collaboration among public and private actors, policy and finance, designers and doers. Finance that lacks alignment with implementation capacity stalls; implementation without finance never scales.

The central truth is that without a stronger execution infrastructure and capability, capital will circulate around ideas instead of through them.

Finance Must Serve Life, Not Just Capital

There is growing recognition across nature finance, catalytic capital, and systems-thinking communities that incremental and optimisation-centric approaches are no longer sufficient. A growing body of thought leadership argues that optimising extractive systems cannot meet planetary boundaries or deliver regenerative outcomes at the scale required [6][7].

As one perspective increasingly shared across the field puts it, we cannot force life into systems designed primarily for extraction. Finance must be reframed so it serves purposeful outcomes and long-term system health, not merely short-term benchmarks or reporting compliance.

This implies a shift from asking whether an initiative is “investable” under existing constraints to asking how capital can be mobilised where it is most necessary, even when this requires new structures, intermediaries, and risk-bearing vehicles.

It also requires acknowledging that traditional financial models tend to underweight long-horizon value creation. Execution, in this context, depends on partners who can bridge disciplines and incentives, creating shared frameworks in which scientists, engineers, policy practitioners, and financiers operate with a common understanding of deliverables, timelines, and outcomes.

Execution Is the Real Competitive Advantage

In a world where ideas are abundant and capital exists, execution becomes the real competitive frontier. The ability to move from concept to deployment, quickly, transparently, and with measurable results, is what separates momentum from motion.

For investors, family offices, foundations, and ecosystem builders, this is no longer a philosophical observation. It is a practical filter:

- Impact capital allocators increasingly need to assess execution readiness alongside technical promise and mission alignment.

- Project sponsors and founders need pathways to scale that are designed from the outset, not added later as an afterthought.

- Financial intermediaries need structures that can absorb early risk while deliberately unlocking larger capital flows downstream.

Execution is rarely glamorous. It is often complex, slow, and operationally demanding. But it is where real-world impact and long-term value creation actually converge.

Where Atlan Operates

Atlan exists precisely in this execution gap.

Not as an idea generator, and not as a passive capital allocator, but as an execution arm designed to mobilise solutions that already exist and move them into the world with speed, discipline, and reduction of risks.

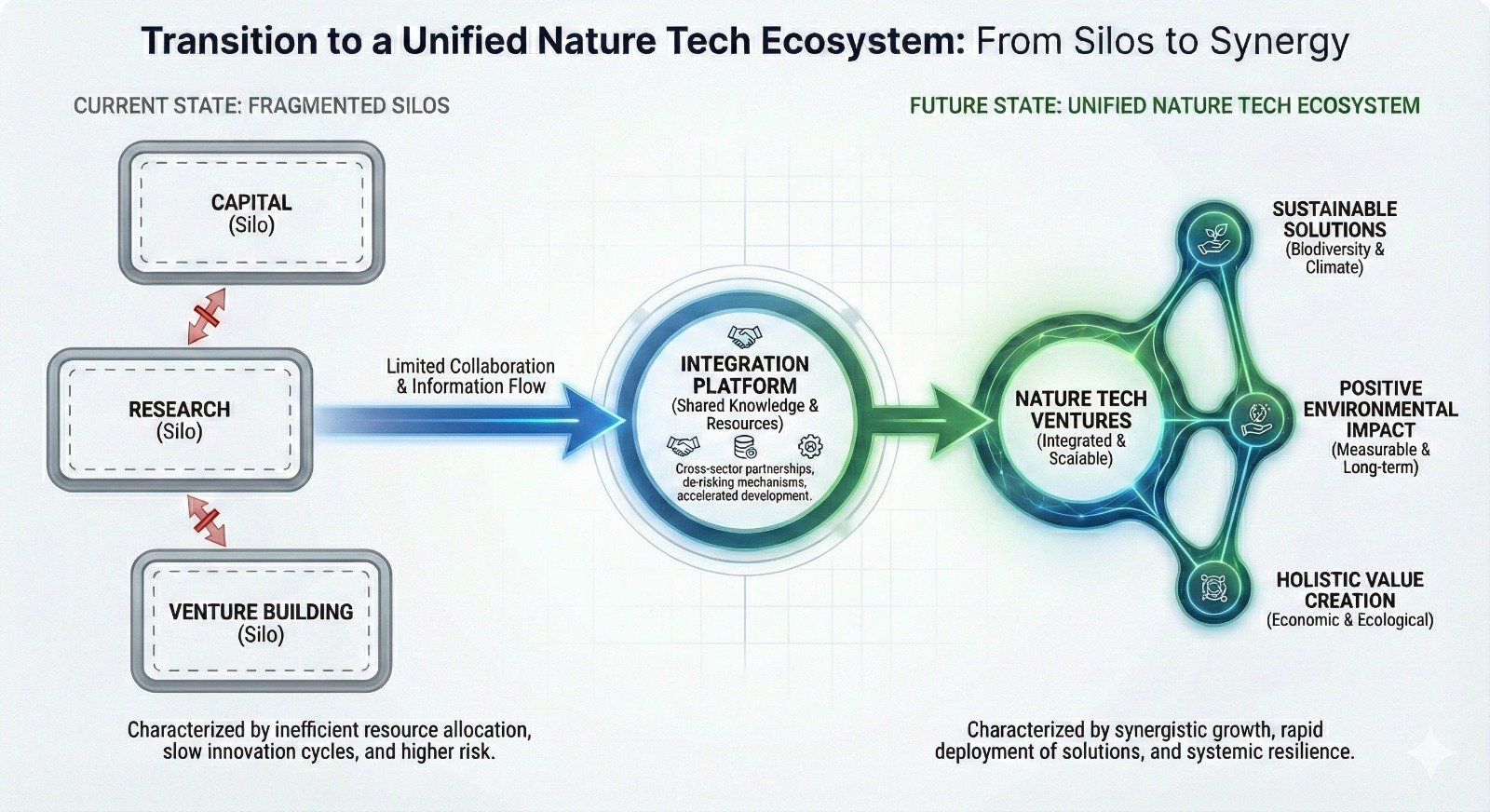

Our work sits at the intersection of three roles that too often remain disconnected:

- Translating scientific and technical breakthroughs into venture-grade, execution-ready companies

- Structuring early pathways that make projects legible and investable for catalytic and long-term capital

- Operating across borders and institutions to reduce friction between research, policy, finance, and deployment

Atlan exists to become an execution infrastructure, designed to work across ecosystems, timelines, and capital types, with a singular focus on turning real solutions into scaled outcomes and collectively protecting and regenerating our natural ecosystems.

Capital is growing. Intent is growing. Execution also needs to grow. It is the real differentiator.

[1] McKinsey & Company (2023–2024), Global Energy Perspective; Net-Zero Transition Pathways (https://www.mckinsey.com/capabilities/sustainability/our-insights)

[2] Climate Policy Initiative (2024–2025), Global Landscape of Climate Finance (https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2025/)

[3] McKinsey & Company (2024), Finance Solutions for Nature: Pathways to Returns and Outcomes (https://www.mckinsey.com/capabilities/sustainability/our-insights/finance-solutions-for-nature-pathways-to-returns-and-outcomes)

[4] Sylvera (2024–2025), Catalytic Finance and Scaling Climate Solutions (https://www.sylvera.com/blog/catalytic-finance-in-asia-whats-needed-to-scale-climate-finance-in-2025-and-beyond)

[5] TAH Foundation (2025), Poropudas, O. Foundations Can Unlock the Green Transition (https://tahsaatio.fi/en/2025/12/18/foundations-can-unlock-the-green-transition/)

[6] Ostara (2025), Adams, J. OBE et al. Reimagining Nature Finance (https://lnkd.in/dBmUuCUH)

[7] Raworth, K. (2017), Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist (https://www.kateraworth.com/doughnut/)

Let's Build What Matters.

We’re always looking for new ideas, research breakthroughs, entrepreneur minds, and mission-aligned investors.

If you believe there’s an immense opportunity in helping nature and society thrive together, we want to hear from you.